Bank regarding Asia Star Smart Home loan

Home ownership are every person’s ultimate fantasy, this is actually the residence where they want to sit back and you can calm down during their senior years ages. Home loans were launched to help people do this dream which have expected financial assistance. Have a tendency to, some one do not have the money to acquire the fantasy household through a down-percentage. Finance companies and you will NBFCs extend mortgage these types of anyone, where merely a limited amount are introduced since the down-fee plus the harmony try financed from the financial institution. Anyone which borrows money from banks and you can NBFC will pay to the financial institution monthly fees, referred to as as the Equated monthly cost. EMI boasts Appeal and you may concept. Among of numerous institutions and this offer home loans in the attractive pricing is Lender out of Asia.

BOI, established in 1906 might have been one of the most leading and you may eldest banks for the Asia that provides a selection of customized banking products and economic remedies for their few people. The lending company was nationalized around 1969 and you can works that have more than 4200 twigs more some other part of Asia.

Certainly one of a great many other novel mortgage choices supplied by BOI are the newest BOI Superstar Smart Home loan which includes certain exceptional provides and benefits and additionally low interest, large quantum away from financing so you’re able to well worth, longer period etcetera.,

Great things about Financial from India Star Wise Home loan

BOI superstar smart home loan is created specifically to provide easy EMI, capability of procedure in order to a multitude of customers. Some of the secret gurus and you will benefits try highlighted below

- Home loan connected with established membership The fresh BOI Superstar Wise Mortgage might possibly be attached to the coupons and you may latest membership kept of the consumer. That it provides the easy while making digital clearing payments otherwise automobile-debit since on specified times.

- Quantum out-of mortgage Minimal amount borrowed was Rs. 5 lakhs (having salaried anyone); Rs. ten lakhs (to own thinking-operating / gurus / company / most other individuals). The maximum maximum can be per the standard mortgage scheme.

- Mortgage period The most period acceptance to own lenders are 3 decades. That it offers the capacity for paying EMIs comfortably. In addition, it means that an earlier personal can be borrow home loan (get a home) at the beginning of the position.

- Interest avoidance means Inside mortgage, the quantity which is over minimal limit from inside the offers and you will most recent account from the financial account, might possibly https://paydayloanalabama.com/petrey/ be moved to the home financing account. This may reduce the focus load on the debtor. Thus, which financial provides the dual advantage of rate of interest recovery and simple liquidity.

- Effortless exchangeability The additional matter about account are used for one almost every other private partnership from the borrower. BOI financial account are operate as an enthusiastic overdraft account towards the the amount of money transferred regarding the membership.

- Pre-closing regarding loan Because too much money on the discounts / newest membership is actually automatically transferred to your house mortgage account, the eye load try less. This is certainly priount thus moved is employed having limited pre-fee out of home loan.

Charges and you will costs

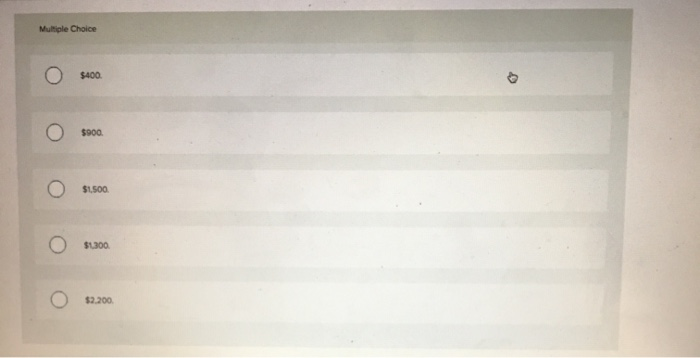

There are certain charges and you may charges of this any mortgage, like the lenders. The costs and you will costs for BOI Celebrity Wise Mortgage try kept very nominal and are also very skilled. Have a tendency to, financial charges are seen to-be highest so because of this, difficult toward borrower. BOI Star Wise Financial vacations that misconception, by offering mortgage at low operating charges. The latest handling costs is fixed on 0.25% of your own loan amount availed. It is irrespective of new quantum away from loan, the minimum charge which can be levied with the mortgage was Rs. 1000 plus the restrict matter rechargeable just like the operating fee is Rs. 20,000. The costs appropriate getting personal clients are in the list above. In case your candidate is a partnership corporation otherwise corporate, this new costs might possibly be twice of what actually is energized on private. There is recovery offered in case the applicant try out of rural urban area, the fresh new running charge might be 75% of what actually is relevant some other (metropolitan / semi-urban) individual consumers.