There is really a loan, called the Zero Doc Loan. It’s ideal for entrepreneurs, buyers, and you may you aren’t unusual otherwise low-documentable earnings.

- Self-functioning home loan software

- Refi, Cash-Away Refi, and purchase

- Top, Next, Funding Land

- Zero tax statements

What exactly is on this page?

Which loan is the best for higher websites worth those who can not establish their earnings so you can be eligible for a traditional mortgage.

Which mortgage could also be titled a great no earnings mortgage as the bank literally does not remark income or a job, several months.

Most other financing, like lender statement money, still be sure money, but through financial places rather than tax statements. Zero Doctor Fund entirely get rid of the earnings verification specifications.

Features a good amount of property, pretty good borrowing from the bank, and a healthy down-payment or present equity? You may be in a position to forget about money confirmation altogether.

Who are Zero Doctor Financing ideal for?

You’ll find a huge selection of borrower profiles No Doctor Funds could help. Below are but a few version of people who you’ll benefit.

- Self-employed anybody

- Small businesses

- A house buyers

- People who have unpredictable however, higher income

- Retired/FIRE’d

To sum up, whoever are unable to document steady money having tax statements otherwise regular financial report deposits could be higher people.

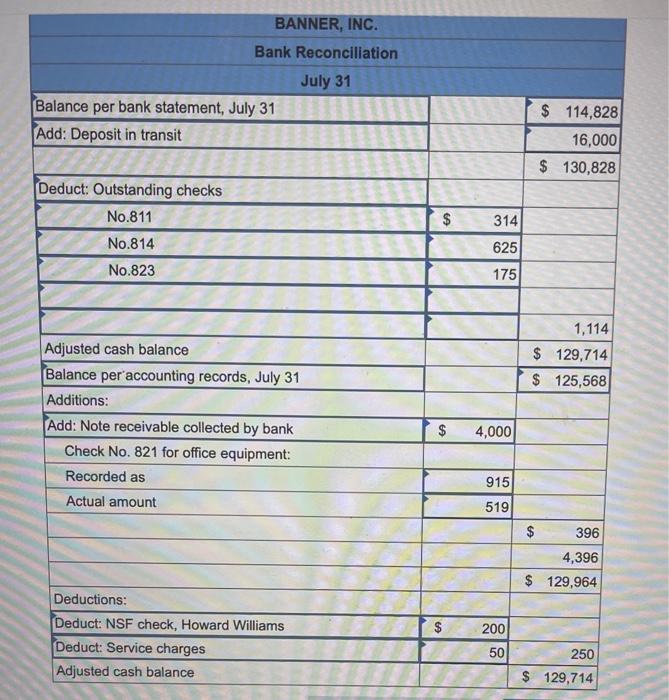

The original a couple legs is actually worry about-explanatory, but what try reserves? These are the quantity of days of repayments inside the set-aside during the liquid assets.

For example, the next domestic percentage are $4,000 as well as dominant, desire, taxes, insurance rates, and you can HOA expenses. One year out of supplies carry out equivalent $forty eight,000. Might you need that it matter left over after since the down payment and you may closing costs.

Now that you see reserves, lower than try a good example of terms that a zero Doctor bank may offer getting primary houses and you can vacation qualities/next land.

Possessions was affirmed with latest bank comments. Most of the money must be seasoned 30 days, meaning since fund are located in your account having thirty day period, he could be believed a without sourcing has to happens.

Maximum loan quantity

Mainly because loans was designed for highest websites well worth anyone, loan wide variety can be quite high. A familiar restrict is actually $step three billion or maybe more.

Zero Doctor Loan companies

Whenever you are No Doc loan providers is actually more challenging to get than just traditional ones, they actually do occur and provide in virtually every condition on the U.S.

Money come from private investors. Lenders aren’t beholden so you can authorities firms to determine legislation. Outside-the-package situations are gladly felt.

To save a little while, you can buy connected to a zero Doc bank from the entry your condition to the lender community.

Zero Doc Financing property designs and occupancy

As the loan places West Cornwall bank features fewer factors on what so you’re able to foot the brand new acceptance, the house more than likely has to be strong. The financial institution tend to acquisition an appraisal to choose value and you may marketability.

As far as occupancy, many No Doc lenders usually agree merely lend on top houses and you may trips land. There are a small number of, even in the event, one to accept money services.

No Doc Loan costs

You certainly will shell out highest rates for no Doctor mortgages than the conventional fund. The reason being not demonstrating new borrower’s income adds a layer from risk.

Nevertheless, this type of loans will be a beneficial well worth, offered their leniency toward old-fashioned financing standards. Communicate with a loan provider to really get your Zero Doctor Financing estimate.

No Doc selection

DSCR financing: Money spent money that foot recognition into property’s income. In the event the leasing money is higher than the fresh new fee, it could be acknowledged. The buyer does not need to bring personal earnings pointers.

Financial declaration mortgage: As opposed to spend stubs or taxation statements, the lending company analysis typical deposits towards the bank comments to verify income.

Owner-filled difficult money financing: Whenever you are difficult money money try generally designed for short-term investment property investment, specific loan providers enables you to make use of them to purchase or refinance an individual house as well.

ITIN loan: Individuals that have an income source however, zero social coverage number otherwise permanent residence condition in the U.S.

FAQ into Zero Doc Money

There are numerous models, however, a popular brand of No Doctor Mortgage is just one from inside the that you be considered according to your credit score and you can level of financial reserves. People with good to higher level borrowing from the bank and you can large internet value get meet the requirements instead of delivering any earnings guidance at all.

No. That you do not county your income and no income is utilized on app. This is called a no-proportion loan since zero debt-to-earnings ratio was determined.

Zero Doctor Funds try judge. The lending company spends different ways to prove the fresh borrower’s power to pay back. Rather than typical earnings, property and credit score will be base out of installment.

Generally, you need a credit score away from 640 or maybe more, a huge deposit away from 20-35%, and 12 to help you a couple of years worth of repayments in the reserve once purchasing the advance payment and settlement costs.

Sure, you could potentially faucet collateral at home provided there was at minimum 31% guarantee leftover yourself after the the latest loan.

Just how to submit an application for a no Doctor mortgage

To apply, select a zero Doc financial that matches your scenarioplete a credit card applicatoin over the telephone to see if you happen to be recognized.

The indicates is founded on knowledge of the borrowed funds business and you can we are intent on helping you reach your aim of having property. We could possibly found compensation out-of companion banking institutions after you view home loan cost noted on all of our web site.