- Create I’ve most other huge expenses coming up? If you want visit the link to save getting things huge, like your kid’s college tuition otherwise a special car, then you might need to run these needs before expenses down the mortgage.

- Really does my personal bank costs an effective prepayment penalty? If you are not sure in case your financial includes that it fee, phone call the lender and have. You will need to estimate the brand new penalty and figure out for those who nevertheless come-out ahead.

Reliable makes it possible to along with your 2nd mortgage refinance. With Legitimate you might contrast prequalified cost off the lover loan providers in only a matter of moments.

- Actual rates away from multiple loan providers During the three minutes, rating genuine prequalified costs without affecting your credit score.

- Sline all the questions you should respond to and you may speed up the latest file publish process.

- End-to-avoid feel Finish the whole origination techniques off rate comparison around closure, all of the into Legitimate.

If you’ve decided one to paying off your own home loan very early ‘s the best flow, there are various ways to go about it. It’s not necessary to put all of your current family savings from the financial obligation. Alternatively, consider these options for paying down their home loan very early:

1. Refinance your financial

If you utilize a mortgage re-finance in order to reduce an effective loan’s name, you might chop years from your fees months if you are purchasing a reduced amount of interest.

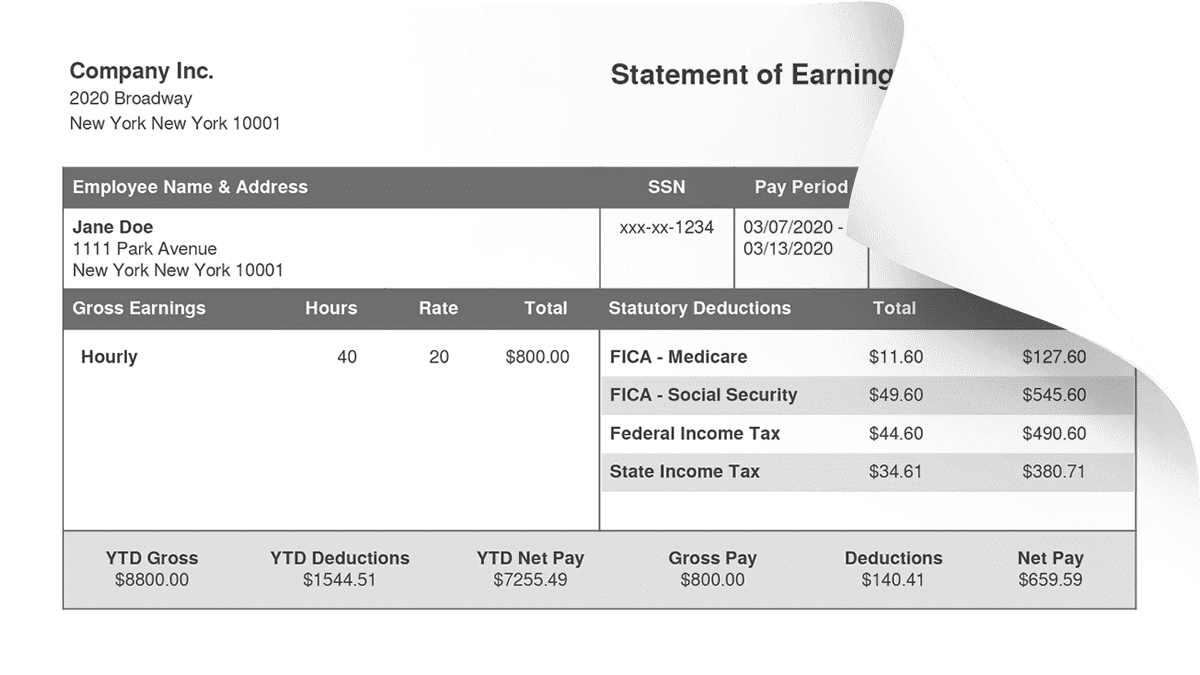

Here’s an example out-of simply how much you may be capable conserve from the refinancing a beneficial $two hundred,100, 30-seasons home loan with the a fifteen-year repaired financing with a reduced home loan interest rate:

Even with a high monthly payment, you’d cut over $56,700 over the life of the mortgage which have a shorter identity, if in case you pay the minimum each month.

Refinancing is not totally free, so weigh the expense off refinancing and you can if or not we would like to refinance to a varying-price mortgage or fixed-price loan.

Reputable can help you locate fairly easily the fresh new home loan re-finance costs. You could contrast several prices from your lover loan providers by using the desk lower than.

dos. Generate biweekly costs

That have a regular home loan, possible generate a fees after each month into longevity of the borrowed funds. Certain mortgage brokers and features allows you to convert to biweekly costs, which can accelerate the rewards by using advantageous asset of just how desire try computed and reduced on the a home loan.

After you spend biweekly, your attention doesn’t gather as often, in order to pay the borrowed funds less. Moreover it results in a supplementary percentage from year to year, as there are twenty-six biweekly money every year versus several monthly obligations.

With this specific early payoff method, the loan was repaid three age very early having a benefit of over $thirteen,five-hundred.

step three. Generate most costs regularly

If you don’t have the money so you can commit to even more costs each month, you can always shell out a lot more if you can be able to. What if you really can afford to spend a supplementary $400 annually. Which will trigger big offers throughout the years.

With an additional $400 per year, in the $eight,500 from inside the attention will set you back disappear from an effective $two hundred,100 home loan and this will be distributed out of on the couple of years ahead of plan.

4. Recast your home loan

Recasting was a way to refresh your home loan instead of the full refinance. When you recast the financial, you make a large, one-day fee towards the loan and also the lender brings an alternative amortization schedule for your loan’s repayments.

The fresh percentage agenda get a lesser payment per month, but you to definitely higher lump sum payment your paid in plus lowers just how far focus are accumulated every month. That isn’t all of that well-known, however it is recommended for most individuals. Consult with your bank to see if its a choice along with your mortgage.